The loan-to-really worth proportion is the number of the loan separated by the automobile’s actual cash worthy of. Loan providers use this formula when deciding whether to provide you money for an automobile or automobile.

When searching for a motor vehicle or vehicles, the loan-to-worth (LTV) is but one component that loan providers used to view your loan app. The greater the new LTV or even the highest part of the fresh car’s value you are credit – brand new riskier financing will be to a lender.

You could potentially reduce the LTV, not, from the boosting your advance payment. It will help slow down the measurements of the loan and you will how much cash appeal you can pay over the life of the mortgage. It can also reduce the interest a loan provider gives you.

That loan with a high LTV was risky for you too. A keen LTV one to exceeds the value of the automobile means your tend to owe over the automobile may be worth more than likely for a long time into the mortgage. In case the automobile is stolen or perhaps in an accident or if you would like to rating a separate one, you can have much to settle before you can should buy a special you to definitely.

Exemplory case of LTV

If you are looking at loans for bad credit Trinity AL open today an excellent $20,000 vehicles but have an advance payment off $5,000, you will want financing to possess $fifteen,000:

Avoiding negative security

It is possible one a keen LTV can exceed 100 percent. If you are to shop for an automobile otherwise vehicles but you actually have that loan in which you owe over the automobile is definitely worth and also you must move it more toward a special loan for a special car the loan amount increase.

If you’re looking at the a great $20,000 car and also no money designed for an advance payment, and have now $5,000 remaining with the people existing car finance, you pay from the delinquent harmony before getting a great the fresh new mortgage. The newest agent may offer so you’re able to roll the fresh new outstanding equilibrium for the the new financing, that could would an alternate bad equity state later on otherwise succeed much harder to locate a separate financing:

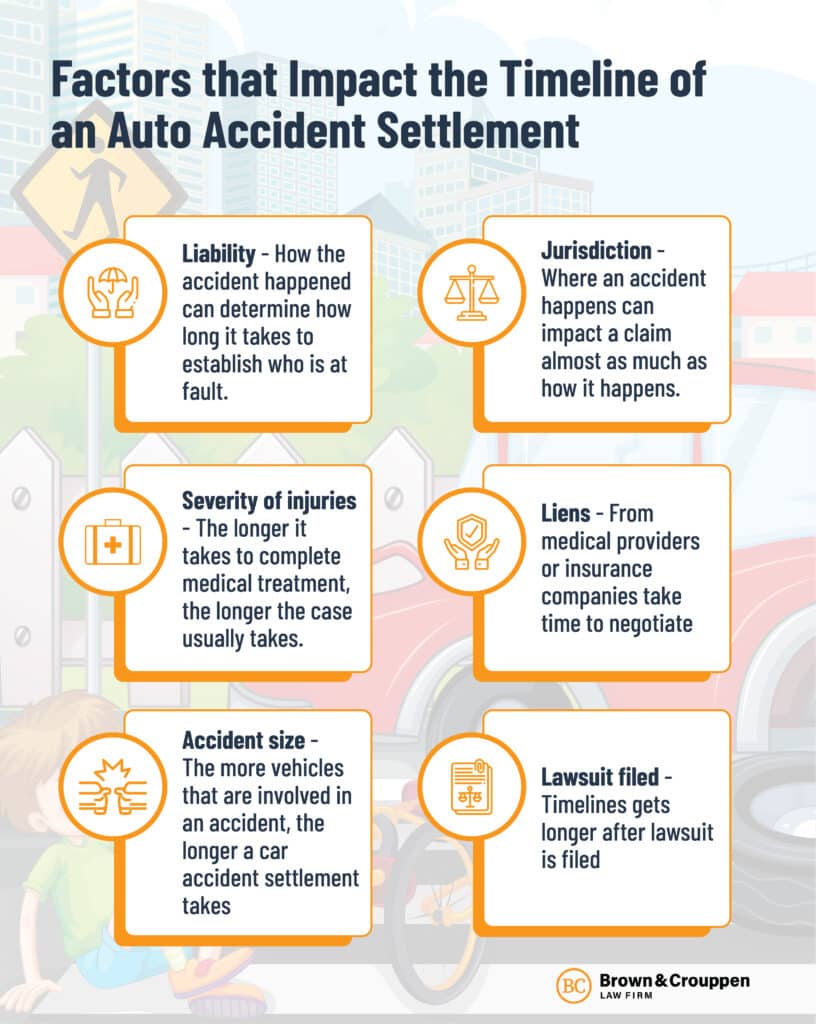

As previously mentioned significantly more than, so it highest LTV you’ll impact whether a loan provider decides to give your that loan, together with regards to a loan and you will interest rate.

Other factors lenders fool around with whenever approving your loan

- Credit score and you will credit rating This is certainly one of the initial products into the choosing if a lender often agree your loan and you can what cost otherwise words they will bring as it will bring understanding of just how much debt you’ve got and how you have treated most other borrowing from the bank levels. Different varieties of loan providers really worth credit rating and you may credit history a lot more into the setting pricing than the others; specific charges the most cost regardless of, it is therefore crucial that you research rates. Discover how the borrowing has an effect on your interest

- Downpayment Again, by the boosting your down payment, your lessen the number you will need to obtain, which decreases the matter possible spend along side life of your own loan and reduces the exposure with the financial.

- Money A loan provider will also fundamentally ask for your month-to-month money and you will a position disease to assess your ability to invest right back the loan.

- Debt to Income (DTI) proportion At the same time, a loan provider will even more than likely see how much cash of one’s income each month is about to other expense. DTI try calculated considering overall monthly payments split up by your pre-tax monthly earnings.

Understand before you could store

There are a few important monetary behavior and make one which just store to possess an automible. See what concerns to ask so you’re able to result in the most useful one for you.

Để lại một bình luận