See the great things about area fee and you can pre-closure regarding loans. Decrease your interest outflow and go monetary freedom that have early installment.

Once we begin working and put out on our personal, there are many hours in which it can make best more affordable sense to take a loan. Including, when you have to put up a home, when you you certainly will book an apartment and you can pay money for brand new book out of your typical money, you would notice it a whole lot more basic to get a home which have the help of financing. This way the bucks used on book you certainly will today be taken to fund the newest EMI. For this reason, what can was indeed an expense might be turned into an resource.

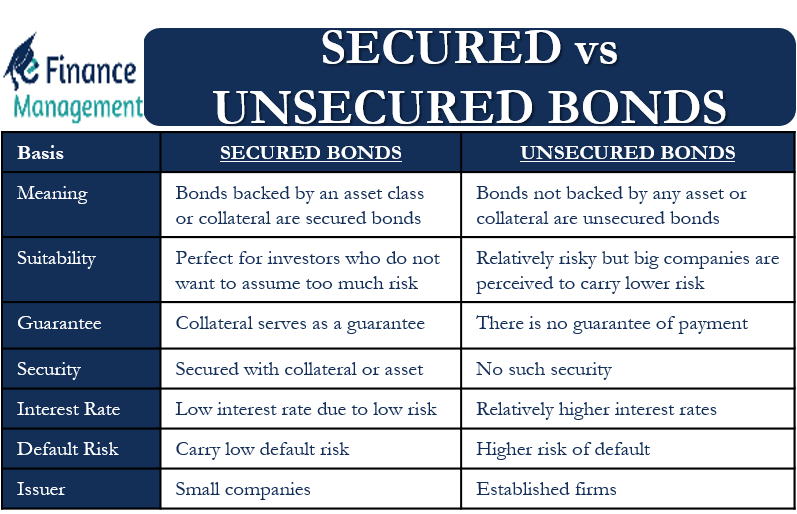

Regardless of the variety of loan you to takes – if a mortgage, a car loan or even a personal bank loan, one should shell out a destination.

There are 2 ways that one can slow down the full attention outflow – area payment otherwise pre-closure. Pre-closing is additionally referred to as prepayment out-of a loan. In this article i talk about in detail what part payment and you can pre-closure/prepayment off financing requires as well as the advantageous assets to the new borrower.

Its relatively easy so you can pre-spend a consumer loan otherwise car finance versus a good home loan as the amount borrowed can often be far reduced. Although not, regarding home loans, this may be more complicated. Although not, any time you are in a substantial amount of cash, you can check out the accessibility to area-commission of your amount borrowed. Contained in this condition, you pay a fraction of their an excellent dominating matter over and you will above the existing EMI. By eliminating the principal number, your slow down the total interest number that would be recharged so you can your if not. The same as prepayment from loans, most lenders commonly levy a punishment otherwise region-payment fees toward signature loans. Regarding mortgage brokers, particular lenders waive which charge.

The fresh new dining table less than will assist you to recognize how a part commission makes it possible to build a complete protecting. They takes on which you have an excellent loan amount out of INR 500,000/- and also INR 100,000/- to own a part-payment. Additionally assumes on that any saving inside the EMIs was invested % per annum.

Prepayment Out-of Money: A great prepayment out of financing occurs when your intimate that loan early if you are paying the complete outstanding prominent and you will attract to the financing at once

As per this type of metrics, because of the partially paying down INR 100,000/- of one’s loan, your might gain INR twenty-six,264/- at the conclusion of the 5-year several months. These types of figures will vary in the event the interest into the loan, interest rate getting investment, financing penalty charges or other factors transform.

We are thus constantly searching for ways and means to settle the borrowed funds on earliest and relieve the eye

So it is vital that you understand the economic benefit to on your own if you decide to pre-intimate financing otherwise choose a part-installment immediately following considering punishment and other costs. Regarding lenders, it’s also advisable to remember the taxation discount work for provided up to INR 150,000/- of your dominating count if you’re creating the new calculation.

Zaroorat aapki. Unsecured loan Humara

Disclaimer: The information contained in this blog post is for general advice purposes only. IIFL Money Minimal (along with the couples and you can associates) (“the business”) assumes zero liability otherwise obligation for all the errors otherwise omissions for the the fresh belongings in this article and on no account shall the latest Providers become responsible for people damage, online payday loans Oklahoma losses, injury or frustration etc. suffered from the people audience. All of the pointers in this article is provided “as it is”, and no make sure out of completeness, precision, timeliness or of performance etcetera. extracted from using this post, and you can instead of warranty of any sort, share otherwise intended, and additionally, not limited to warranties regarding results, merchantability and you may exercise to own a specific mission. Given the changing character from statutes, rules and regulations, there is delays, omissions or inaccuracies on the information within article. All the information about post is provided with brand new understanding that the organization is not herein involved with rendering courtroom, bookkeeping, tax, or any other qualified advice and you will services. As such, it should never be used alternatively having appointment with elite accounting, taxation, court and other skilled advisors. This informative article get consist of views and viewpoints which happen to be the ones from the newest article writers and do not always mirror the official plan or status of any almost every other service otherwise providers. This particular article may also incorporate backlinks to external other sites that are not made otherwise maintained from the or perhaps in in whatever way associated with the business while the Team doesn’t ensure the precision, value, timeliness, otherwise completeness of any details about these types of additional other sites. Any/ all of the (Gold/ Personal/ Business) financing device requisite and you may information one possibly produced in this short article is actually susceptible to go from time to time, clients are encouraged to reach out to the company to possess newest criteria of your own said (Gold/ Personal/ Business) financing.

Để lại một bình luận