Since a mortgage elite, you understand the homebuying processes can be both fun and you can exhausting getting consumers. Regarding securing an interest rate, one of the most significant situations one to loan providers determine is actually an effective borrower’s credit file and credit rating. You may already know, choices to your a beneficial borrower’s credit report may have a deep impression on their home mortgage application.

Even though it is not best getting personal debt within the series during the borrowed funds mortgage procedure, it is a sad reality one to some consumers deal with. Because the a mortgage broker, its element of your task to talk about how this case could possibly get perception their ability to help you secure a mortgage loan. Below, we created a borrower-amicable guide overviewing particular areas where collections make a difference to an excellent borrower’s mortgage app, including a specific focus on the impact regarding medical collections.

1. Effect out of Series

Scientific stuff will occur off outstanding scientific bills. This type of stuff may seem quicker significant than other versions, nonetheless might have a similar disastrous influence on a mortgage software. The new feeling off scientific selections towards a mortgage loan software program is serious, since they’re addressed like other stuff from the most loan providers.

Despite particular previous changes in credit reporting patterns, medical selections might still signal to help you loan providers a threat when you look at the financing to help you a borrower, perhaps ultimately causing large interest rates or even outright assertion of their application. When possible, a borrower need to answer medical collections before you apply to own a home loan.

dos. How Choices Perception Credit ratings

A credit score is actually a numerical symbol off good borrower’s creditworthiness. Choices normally down that it score by a significant margin. Also brief stuff can result in a decrease, probably affecting their home loan interest rate or qualification.

3. The brand new Timing out-of Choices

Elderly selections weigh shorter greatly on a credit history, however they are nevertheless visually noticeable to loan providers. Current collections, like over the past 2 yrs, is such as for example harmful to a home loan software. Knowing the schedule out of collections to their credit report might help a borrower strategize in their application process.

cuatro. The latest Part out-of Range Number

The amount owed inside the choices also can impression a beneficial borrower’s financial application. Larger number could possibly get denote higher risk so you can lenders. When possible, individuals should think about paying or discussing this type of number off, so they can let you know loan providers that they’re delivering significant actions to help you look after the trouble.

5. Exactly how Some other Lenders Check Choices

Additional lenders enjoys other formula out-of choices. Certain tends to be significantly more lenient, such as for example which have medical collections, while others could have strict statutes which make obtaining a mortgage more challenging.

six. Courtroom Factors

Based their legislation, there might be judge considerations from stuff as well as how he or she is said. It is essential to own a debtor understand its liberties and you may search professional recommendations to greatly help protect on their own inside the home loan application process.

In the event that a debtor does eventually possess series to their borrowing from the bank declaration, inform them not to anxiety. Below are a few suggestions you could focus on by individuals you to definitely will help boost their state:

- Trying to elite group credit guidance.

- Negotiating for the collection agencies.

- Paying off selections in which feasible.

- Think implementing with an effective co-signer.

- Dealing with loan providers just who concentrate on individuals that have credit demands.

8. The newest Effect on Financing Brands and you can Applications

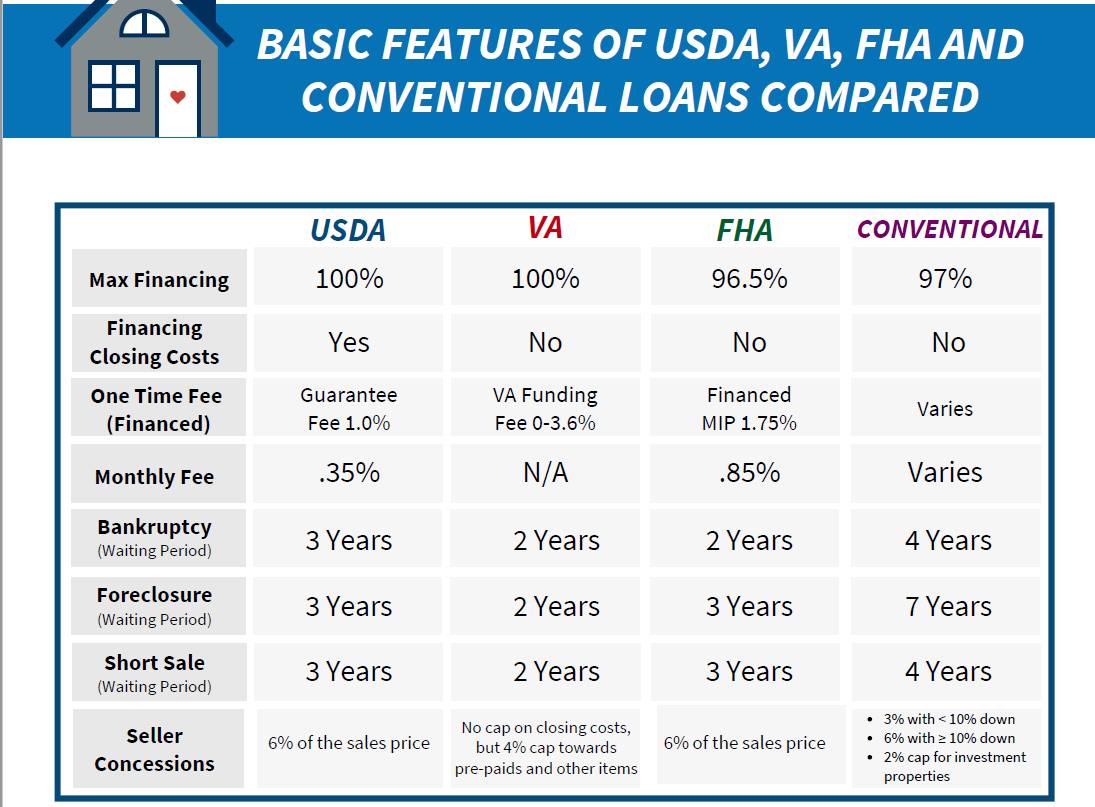

For instance, government-recognized fund particularly FHA (Federal Houses Administration) might have way more easy recommendations off series, whenever you are conventional financing could be stricter. Taking walks cash advance america Placerville Colorado individuals from some other financing brands and you may applications as well as their thinking on the series will help book individuals off to the right mortgage.

nine. Brand new Effect from Paid off Against. Outstanding Selections

However, the main thing you to definitely consumers know that simply repaying collections will not erase them off their credit file instantly. Paid down collections can always impact a mortgage software, no matter if they frequently bring faster pounds than simply unpaid ones.

10. Collection Practices and you can User Rights

A thorough understanding of rights less than laws like the Reasonable Financial obligation Range Practices Operate (FDCPA) would be crucial in approaching choices for borrowers.

People keeps legal rights concerning the how debt collectors is contact all of them, whatever they can say, and a lot more. If a collection department violates these types of laws and regulations, this may impact the revealing liberties. Experience with these rules is also encourage borrowers for taking control over their financial situation.

11. Provided Credit Fix Attributes

These types of services can perhaps work having individuals to handle discrepancies inside their credit report, discuss having debt collectors, and create techniques to enhance their borrowing throughout the years. Going for an established borrowing from the bank repair solution can be a strategic disperse so you can mitigate the new effect away from series on the amortgage application. Consumers should make sure to research very carefully and understand the will set you back and you can potential advantages inside it.

a dozen. Building A powerful Economic Foundation Article-Selections

Once addressing choices, it’s a sensible circulate to own borrowers to a target strengthening an effective powerful economic base to eliminate upcoming stuff and you may borrowing pressures. Just like the a starting point, below are a few methods to indicate:

Budgeting Smartly: Make a spending budget complete with offers, allows for prompt commission of all the bills, and you can wants future financial needs.

Keeping track of Credit: On a regular basis checking their credit file ensures that they understand out of one changes otherwise inaccuracies, permitting borrowers to deal with all of them punctually.

Seeking to Constant Economic Studies: If because of professional economic guidance, discovering, otherwise online programmes, went on studies on the personal loans could easily assist bolster good borrower’s monetary balances.

- To prevent The Loans Pitfalls: Are mindful of the borrowing from the bank personal debt and managing them sensibly support avoid coming choices and holds monetary fitness.

End

Of the understanding the different aspects out of selections, using their affect credit ratings so you’re able to liberties and differing financing programs, prospective homeowners are ideal happy to realize the homeownership hopes and dreams.

Be it working privately which have collection agencies, given different financing items, or looking to borrowing repair properties, there are numerous routes to help you mitigate the challenges presented of the selections. Providing borrowers engage with the method proactively and you can carefully will help them move forward from this type of obstacles and you may to their dream house.

Looking to feel the most widely used home loan information delivered directly to the inbox? Create the latest wemlo publication where in actuality the #teamlo series in the latest company and you may financial trends all in you to place.

Để lại một bình luận