If you are searching for household security loan costs during the Arizona, you’re in the right spot. Come across below to your most recent Washington family collateral mortgage rates available now away from a wide variety of loan providers.

Property guarantee loan is a type of financial used by many people people for the Arizona so you’re able to borrow on family security. A home guarantee mortgage now offers entry to cash which is often familiar with combine debt, purchase home fixes or developments, otherwise create a large buy.

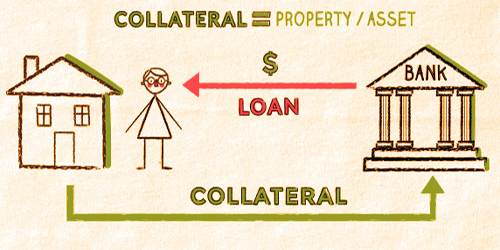

Family guarantee money use your household while the equity, thus these are typically finest utilized by financially responsible homeowners that high collateral within their homes.

Today’s Washington Home Security Financing Pricing

Find lower than getting today’s home equity mortgage cost in the Arizona. Interest levels are subject to field requirements and certainly will changes at any time without notice.

What is actually a house Security Loan?

Property equity financing enables you to acquire a lump sum of money from the equity of your house. Domestic equity is the difference in your house’s market value and people a great mortgage stability.

House collateral fund are like personal loans and cash-away refinances because they always feature fixed interest levels and a completely-amortized payment that pays the mortgage at the conclusion of the borrowed funds title.

Most home security finance was created since second mortgages at the rear of a keen existing first mortgage, nevertheless don’t need to currently have home financing to find a home security mortgage.

You can even listen to the term household guarantee financing used interchangeably toward title household guarantee personal line of credit, otherwise HELOC. HELOCs are a variety of house security mortgage, but they are usually revolving (for example credit cards), have appeal-merely payments (in mark months), and changeable rates of interest.

The home security loan we are making reference to right here normally comes with a predetermined price, lump sum commission, and you may a flat payment several months (such as 10 years, fifteen years, etc.).

- Shorter mortgage number. A property guarantee mortgage can be a better alternative than simply an effective cash-away refinance or even you desire most cash. Of a lot loan providers have minimum loan quantities of $50,000 to help you $75,000 for cash away refinances.

- Keep your no. 1 look at this web site loan. A home guarantee loan makes you borrow against their security instead refinancing your mortgage. This will be a huge advantage when you have a low interest rate speed on your own present financial.

- All the way down settlement costs. Family equity fund often have all the way down settlement costs than simply bucks-aside refinances.

- Repaired pricing and you may loan conditions. Very household equity loans enjoys repaired rates of interest. Of numerous home owners choose household guarantee fund more HELOCs thus. HELOCs usually have adjustable interest levels you to transform toward best speed. In the event that primary rates expands, HELOC prices (and you may costs) boost also.

- Smoother app techniques. The application form techniques can often be easier and reduced to have a property guarantee loan than for a funds-out re-finance.

- Large rates than other mortgage alternatives. Arizona family collateral loan cost tend to be greater than bucks-out re-finance otherwise HELOC interest levels.

- Shorter loan terms and better repayments. Family security financing usually have large money while the mortgage terms was smaller. Yet not, remember that the brand new faster financing title does mean you might be settling the borrowed funds less.

- You must acquire a complete number beforehand. Very home security financing just have a lump sum payment commission. You have got to obtain a full number beforehand even if you don’t need the currency now. It’s also possible to consider good HELOC if you’d like significantly more borrowing from the bank independence than a property security loan can offer.

Để lại một bình luận