In double-entry bookkeeping, a widespread accounting method, all financial transactions are considered to affect at least two of a company’s accounts. One account will get a debit entry, while the second will get a credit entry to record each transaction that occurs. Since so many transactions are posted at once, it can be difficult post them all.

Start today and see why businesses choose Brixx

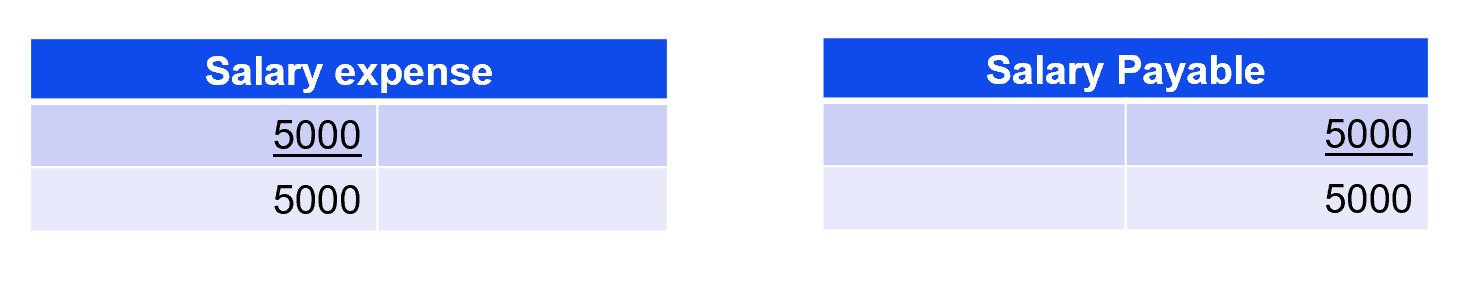

The left-hand side is where you enter debits whilst the right-hand side is where you enter credits. Understanding the difference between credit and debit is essential for this process. Due to the fortunate ‘T’ shape, these diagrams can be used to map out transactions before they are posted into the company’s ledgers to ensure they are correct.

How T Accounts are Used

You do this by using a T-account with debits on the left and credits on the right. Students can use t accounts to learn about accounting and how transactions affect different accounts on the general ledger. The corresponding journal entry for the above T account expenses example would look like this. A T-Account can be created by manually drawing out the two columns, labeling each one as Debit and Credit. Alternatively, many accounting software packages allow users to enter accounts they wish to track and automatically generate a T-Account. Brixx, our financial forecasting tool, helps you with this process further.

What is Qualified Business Income?

Accountants and bookkeepers often use T-accounts as a visual aid to see the effect of a transaction or journal entry on the two (or more) accounts involved. If you set up the t-accounts for the journal entries, start by posting the original balances. Then, post the adjusting balances, and you will be able to see how each of the accounts changes. The easiest way to show how to do T accounts is by looking at an example.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Your profit & loss organises your revenue and expense accounts whilst your balance sheet organises your asset, liability and equity accounts.

- A T-Account is a visual presentation of the journal entries recorded in a general ledger account.

- Each journal entry is transferred from the general journal to the corresponding T-account.

- The T-account is a quick way to work out the placement of debits/credits before it’s recorded in full detail to help avoid data entry errors.

For different account types, a debit and a credit may increase or decrease the account value. A T account (or general ledger account) is a graphical representation of a general ledger account. The general ledger is an accounting report that sorts and records a business’ financial transactions, by account. A T account resembles the letter T and visually represents the debit and credit entries of financial transactions.

Create a Free Account and Ask Any Financial Question

I’m almost 30 and would like to continue nannying for another 15 or even 25 years. I can’t see anyone employing me when I’m 50, but at the same time, I can’t imagine doing another type of work. Not everyone wanted to be social with me or the kids I nanny, increase manufacturing capacity in times of crisis with lean principles while some people weren’t pleased that I was doing so well in this career. Some people don’t want to work with me because I’m a male nanny, or manny, as I say. I used to think that was from ignorance, but I’ve realized it’s just a preference.

This T format graphically depicts the debits on the left side of the T and the credits on the right side. This system allows accountants and bookkeepers to easily track account balances and spot errors in journal entries. T-accounts are used to visualize the balances of individual accounts. While a journal entry is a record of a single transaction in chronological order, showing the debits and credits of each account affected.

A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. The purpose of journalizing is to record the change in the accounting equation caused by a business event. Ledger accounts categorize these changes or debits and credits into specific accounts, so management can have useful information for budgeting and performance purposes. Once journal entries are made in the general journal or subsidiary journals, they must be posted and transferred to the T-accounts or ledger accounts.

Để lại một bình luận